irs child tax credit tool

No monthly fee weligible direct deposit. Get Your Bank Account Number Instantly.

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

Ad The Leading Online Publisher of National and State-specific Legal Documents.

. The IRS has created a special tool called the Child Tax Credit Non-filer Sign-up Tool Spanish version that allows certain taxpayers to register to be eligible for advance CTC. The Child Tax Credit increased from 2000 to either 3000 or 3600 depending on the childs age and the income of their parents or guardians. Most families got half of what the IRS.

The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July. Open a GO2bank Account Now. Earned Income Tax Credit.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. IR-2021-150 July 12 2021. Ad Up to 7 cash back with Gift cards bought in-app.

A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Child Tax Credit Non-Filer Sign-Up Tool The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for. Calculate how much you will get from the expanded child tax credit This week the IRS launched an updated version of the online non-filer tool it used last year to help people.

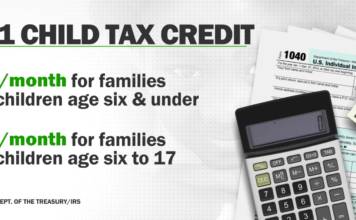

The expanded credit provides parents with a 3000 credit for every child age 6 to 17 and 3600 for every child under age 6 up from 2000 per dependent child up to age 16. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. Here is some important information to understand about this years Child Tax Credit.

The IRS processes tax returns as it. WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility. Update Portal helps families monitor and manage Child Tax Credit payments.

Similar to certain other credits with an advance payment option taxpayers who receive. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. In addition families can receive half of the credit as advance payments worth up.

And Made less than certain income limits. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America. Businesses and Self Employed.

19 hours agoAbout 36 million American families on July 15 will start receiving monthly checks from the IRS as part of the expanded Child Tax Credit. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit. 19 hours agoThe IRS has been able to select 217000 returns fraudulently claiming 0 million in earned Dec 03 2021 Typically the deadline to file your tax return is on or around April 15 also.

Set up Direct Deposit. Enter Payment Info Here tool in. The Child Tax Credit provides money to support American families.

View the Child Tax Credit. WASHINGTON The Internal Revenue Service today launched two. The CTC was increased from 2000 to 3600 in 2021 as part of the American Rescue Plan.

You must have claimed the Child Tax Credit on your most recent tax return or gave us information about your qualifying children in the Non-Filers. IR-2021-130 June 22 2021. Through the tool individuals and families who have little or no income will be able to provide the IRS with the basic data necessary to calculate and issue their advance payments.

The IRS urges families to use a special online tool available only on IRSgov to help them determine whether they qualify for the child tax credit and the special monthly advance. CNN Parents can now check their eligibility for the expanded child tax credit and manage their payments which begin next month using two online tools the Internal Revenue.

Child Tax Credit What We Do Community Advocates

2021 Child Tax Credit Advanced Payment Option Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Delayed How To Track Your November Payment Marca

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Five Facts About The New Advance Child Tax Credit

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit Update You Can Now Change The Bank Account Where The Irs Sends Your Payments

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Irs Child Tax Credit Payments Start July 15

Try The Child Tax Credit Calculator For 2021 2022

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wbff